In this article, I’ll compare, contrast, and give my opinions on the two leading U.S. EV startups, Rivian (NASDAQ:RIVN) and Lucid (NASDAQ:LCID). Before diving in, there are two points I want to get across:

These are high-risk stocks. I don’t own either stock currently, largely because of the risks associated with scaling production and reaching positive cash flow, which alone may not even be enough to justify their current valuations.

There are many structural advantages both companies have over legacy automakers like Ford and GM. Many of the issues restricting the valuations of traditional auto OEMs don’t apply to Rivian and Lucid. I wrote about this here and here, which gives important context for this discussion.

This article has five sections:

History

Shareholders and partnerships

Product offering

Financials and valuation

Summary

History

Rivian

Robert “RJ” Scaringe founded Rivian in 2009 and has been the CEO since. Rivian unveiled its first two products, a pickup truck and SUV, in December 2017 and acquired its Normal, IL facility from Mitsubishi for $17M in January 2018.

The first R1T pickup truck was produced in September 2021 and Rivian subsequently raised $13.5B through a traditional IPO in November 2021. As of July 2022, Rivian had ~14,000 employees.

Lucid

Lucid is led by Peter Rawlinson, who joined as CTO in 2013 and was appointed to CEO in 2019. Rawlinson served as Tesla’s VP of Vehicle Engineering from 2010-2012 and was a senior engineer on the Model S. Rawlinson’s true involvement and impact at Tesla is debatable, but it’s clear he left Tesla well before initial production challenges were solved.

In November 2016, Arizona officials announced the planned construction of Lucid’s $700M factory in Casa Grande. Original plans were for vehicle production to begin in early 2019, but construction didn’t begin until December 2019. Lucid went public through a SPAC, which raised $4.4B and closed in July 2021. Initial vehicle production began shortly after in September 2021. As of June 2022, Lucid had ~5,600 employees.

Conclusion

Both Rivian and Lucid are at similar stages and that’s part of what makes this comparison so interesting. Both companies make only fully electric vehicles (no hybrids), were founded within a couple of years of each other, and began customer vehicle production in the same exact month. They also have similar market caps today, which makes the comparison very relevant from an investor perspective.

While both companies have had their fair share of executive turnover, Lucid has experienced more management departures. Lucid has shaken up its leadership team in both May and September of this year as the company struggles to ramp production. Another interesting data point is that Lucid’s current SVP of Digital, Michael Bell, was Rivian’s COO for nine months from 2019-2020.

Rivian’s background is cleaner from an investor perspective, partly because of the traditional IPO, founder-CEO dynamic, and stronger management continuity. More importantly, Rivian has had more success than Lucid in ramping initial production. Rivian’s decision to inherit an existing existing auto factory (similar to what Tesla did with its Fremont factory), rather than build one from scratch, helped accelerate and simplify initial production.

Ownership and partnerships

Rivian

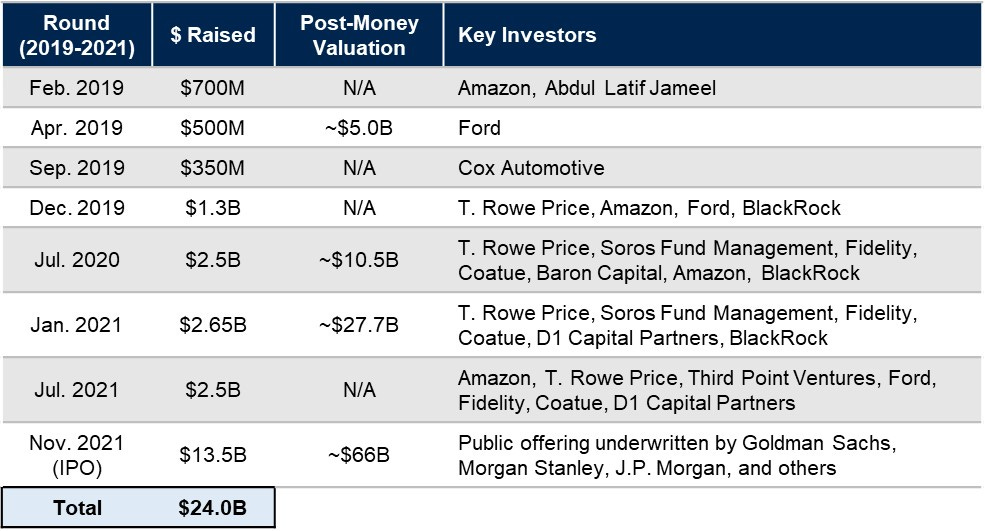

Rivian mostly raised capital through angel investments and loans until its first large equity financing round in February 2019. From 2019 to 2021, Rivian raised a whopping $24B in equity capital, in addition to $1.25B in debt via Senior Secured Notes.

Many of these investors have trimmed their stake after the IPO lockup expiration but are still major shareholders. Below are Rivian’s top shareholders as of Q2’22. Note that this includes 908.4M Class A shares (1 vote each) and 7.8M Class B Shares (10 votes each), which are all held by CEO RJ Scaringe.

While the institutional investor list is impressive, the strategic partnerships and agreements are more important. Rivian’s first three major equity investors were Amazon, Ford, and Cox, respectively, each bringing their own unique value-add.

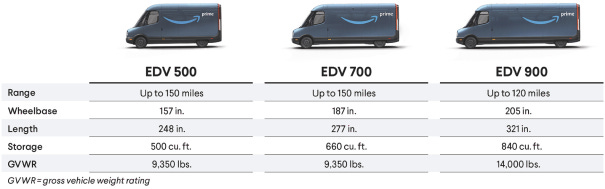

In September 2019, Rivian announced that it was developing a custom electric delivery van (called the EDV) for Amazon and that 100,000 of these vans had been ordered, with deliveries starting in 2021. Initial deliveries of the EDV didn’t happen until July 2022, but they are currently being used by Amazon to deliver packages in the U.S. This Rivian collaboration is a part of Amazon’s plan to convert its delivery fleet to 100% renewable energy by 2030.

On September 9, 2022, Rivian also announced a strategic partnership with Mercedes to produce electric vans in Europe. This is significant because Mercedes is one of the largest producers of vans globally, selling about 400,000 units annually. This further validates Rivian’s technology and strategic positioning relative to other EV startups.

Lucid

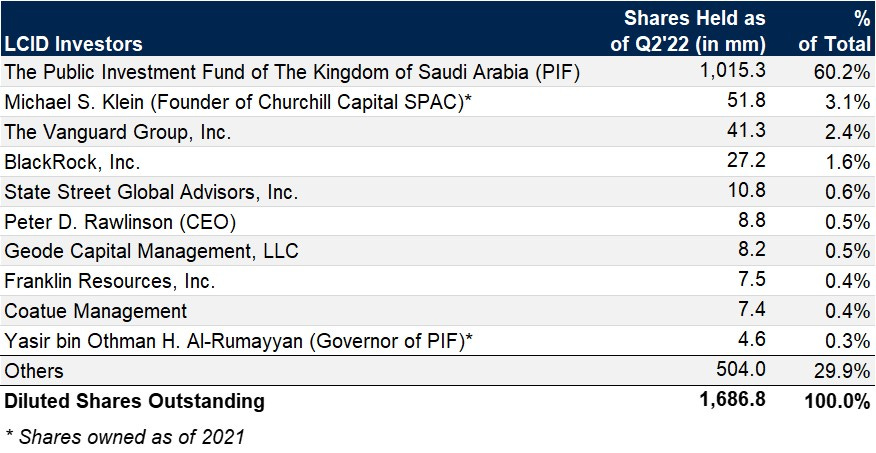

Lucid has also raised mostly equity capital throughout its history, most notably through its SPAC merger in 2021. There are few public fundraising details prior to its SPAC combination, but Lucid certainly raised less capital than Rivian. The company’s largest shareholder, by far, is the Public Investment Fund of Saudi Arabia (PIF). In fact, PIF owns over 60% of the shares outstanding, an abnormally large stake for a company of this size.

The investment from PIF also comes with product orders. In April 2022, the government of Saudi Arabia agreed to buy between 50,000-100,000 Lucid vehicles by 2030. This is a solid agreement that guarantees future product demand, but does little to help them ramp production, which is the company’s biggest challenge today.

Conclusion

Both companies have a well-capitalized partner that can provide additional liquidity, if needed, in addition to billions of dollars worth of pre orders. However, only Rivian’s partnerships are beneficial from a strategic perspective. The Amazon partnership validates Rivian’s technology and tests its products by using vans for high-volume package deliveries across the country. Developing an electric van with Mercedes is another distinct advantage that will be a great learning experience.

With that said, these partnerships do add complexity. Rivian has to balance ramping production of its consumer vehicles at the same time as its commercial vehicles for Amazon. The R1T and R1S are actually built on the same production line, so that second SUV model doesn’t add much complexity, but the EDV does. A lot of Rivian’s cash burn and ramp-up costs are associated with the additional EDV production line.

I view the outsized ownership of Saudi Arabia as a negative for Lucid. This is an example of poor corporate governance, where PIF essentially controls the company and can influence management to protect their best interests. This has already come to fruition, as Lucid needs build a factory in Saudi Arabia. Construction is expected to start soon despite the fact that this makes no sense for the business.

Lucid is still struggling with production and already has to begin building a new facility in another continent. This will take away resources from its Arizona plant, especially once production lines are being installed in Saudi Arabia. It’s too early for Lucid to apply learnings from its Arizona factory in designing its second facility. Additionally, Saudi Arabia isn’t a large car market with only about 500,000 vehicles sold annually. Yes it’s located near Europe, but Lucid will still need to pay incremental shipping, transportation, and tariff costs than if its factory was directly located in Europe. In fairness, Rivian is also planning its second factory, but at least the location (Georgia) makes sense and was selected by management, not a majority shareholder.

Product offering

Rivian

Rivian’s current consumer product offerings are a pickup truck (R1T) and a seven-passenger SUV (R1S), both manufactured on the same production line. Below are more detailed specs for these models, as currently available.

Rivian has ramped production of the R1T quickly (more on that in the financial section). Despite beginning production less than a year ago, the R1T was already the 11th best selling EV in the U.S. through the first half of the year. That’s right, the R1T alone sold almost as many units (5,590) as all pure EVs from Toyota, BMW, and Mercedes combined (5,724) in H1’22.

Rivian is also addressing commercial applications with the EDV. These are just being produced for Amazon today, but will likely serve a broader customer base as production scales. The range of just 120-150 miles is much lower than the range of their consumer vehicles, which is a bit disappointing. Other specs and pricing details aren’t publicly available since these vehicles are exclusively for Amazon until next year. It’s unclear what type of discount Amazon is receiving, if any, relative to what other delivery companies would pay.

Of course, Rivian envisions offering additional models at lower price points in the future. The next-gen vehicle models will be under a new R2 platform. There aren’t many details available, but these won’t be released until 2025 at the earliest. My best guess is that Rivian will offer a smaller, cheaper truck and SUV for its next two consumer products. This would be similar to Tesla’s strategy, beginning with the more expensive Model S and X sedan and SUV, respectively, before offering the smaller and cheaper Model 3 and Y.

As of June 30, 2022, Rivian had ~98,000 net pre-orders, excluding Amazon’s orders.

Lucid

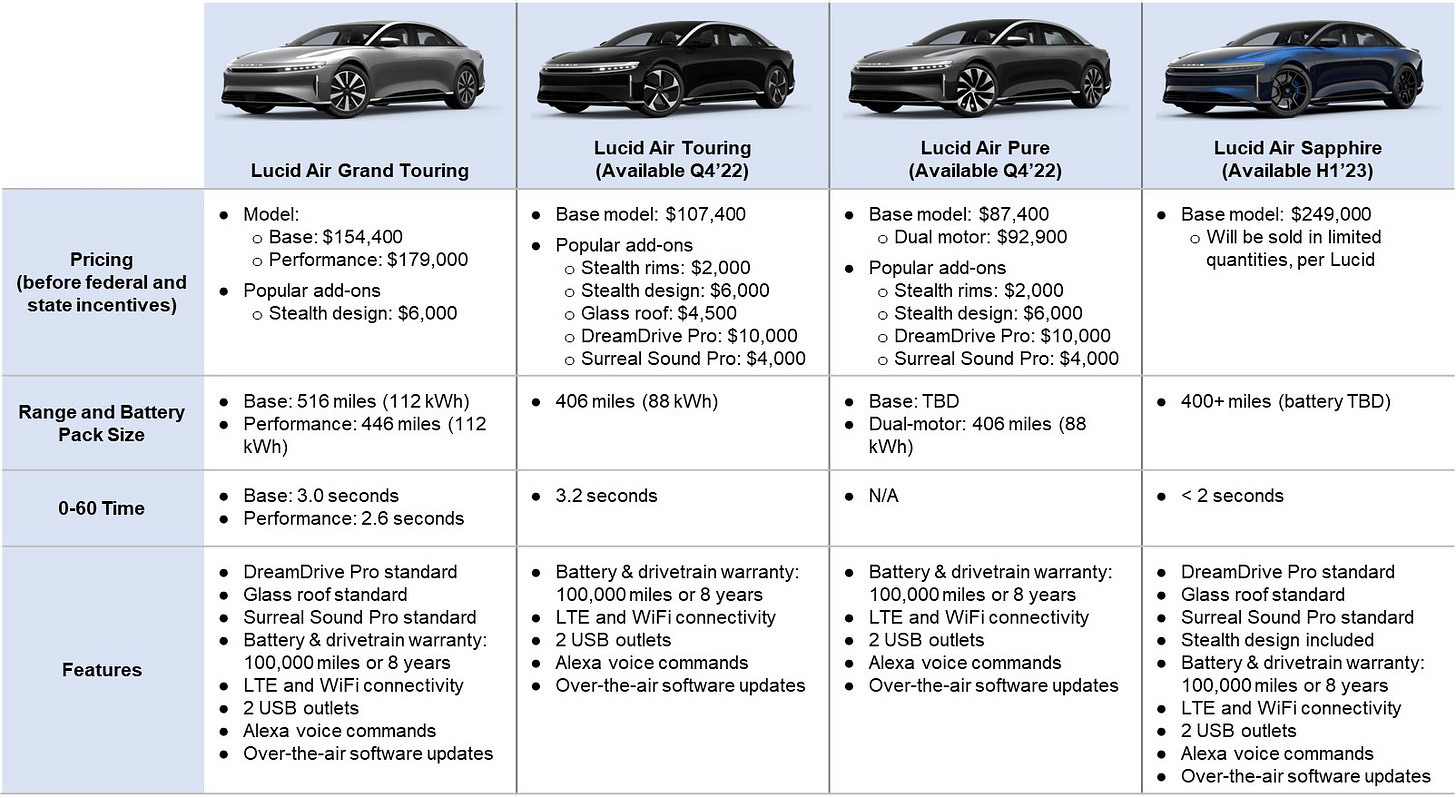

Lucid’s current product offering is more narrowly focused since it only offers only one variant of one model, the Air luxury sedan. Maybe the most notable aspect of Lucid’s product offering is the range: the Air has the highest range of any EV ever tested.

Lucid will begin delivering new variants of the Air over the coming quarters. The Air Touring and Air Pure will put downward pressure on Lucid’s average selling price (more on that in the financial section).

The $249,000 Air Sapphire may help offset some of the decrease in average selling prices, but Lucid openly admits this variant will only be produced in limited quantities. I’m not sure it’s worth the extra effort and resources to make this model given their current production issues.

Aside from the Air. The only other model that’s been discussed is the Lucid Gravity, a luxury SUV that’s set to release in 2024. There are no details on pricing or other specs, but the Gravity will likely be priced similarly to the Air.

As of August 3, 2022, Lucid had ~37,000 net pre-orders, excluding PIF’s orders.

Conclusion

Both Rivian and Lucid offer compelling products that have been well received by initial customers. There are still many product and service related issues that both companies need to work out, but this isn’t surprising since they just began making their first cars less than a year ago. Both companies have already issued product recalls, Rivian for airbag issues and Lucid for screen display issues. While this may seem concerning, recalls are very standard in the industry. In fact, there were over 1,000 different automotive recalls in the U.S. in 2021 impacting 35 million vehicles.

The Lucid Air may have the longest range of any EV, but what’s more impressive is the battery efficiency. The Air Grand Touring’s Range / kWh is 4.6, which is second to only Tesla’s Model 3. This is a testament to Lucid’s engineering strength and ability to minimize the weight of their cars. Lucid also benefits from much higher ASPs, which allow the company to procure more expensive and lighter materials. Rivian has room for improvement here and needs to reduce the weight of its vehicles, among other areas, to improve efficiency. While trucks are heavier than sedans, even Tesla’s Cybertruck is expected to weigh 30-45% less than the R1T.

Rivian’s end markets (pickup trucks and SUVs) are significantly more popular than Lucid’s (sedans), both in the U.S. and globally. In fact, the top three selling models in the U.S. in H1’22 are all pickup trucks! Eight of the top models are either pickup trucks or crossovers/SUVs, while only two are sedans. Overall, ~50% of the vehicles sold in the U.S. are crossovers/SUVs and ~20% are pickup trucks. The mix of sedan sales is just ~15% and continues to trend lower.

Rivian is serving larger parts of the consumer market, but its products also cover commercial applications, which Lucid doesn’t address at all. By serving Amazon and other enterprises, Rivian’s product lineup covers a much larger addressable market than Lucid’s, which paves a clearer path for strong long-term growth.

Both company’s products are too expensive for the average consumer today, and their goal is to offer cheaper vehicles in higher quantities, but Rivian is better positioned to achieve this. Rivian’s products address larger parts of the auto market, are more affordably priced today, include more standard features, and have higher utility. This is partly why Rivian has ~98,000 pre-orders compared to ~37,000 for Lucid. Rivian is also further along in their production ramp and product roadmap, as Lucid is still years away from releasing its second model, which will still be a niche/luxury product.

Financials and valuation

Rivian

Below are Rivian’s key financial metrics.

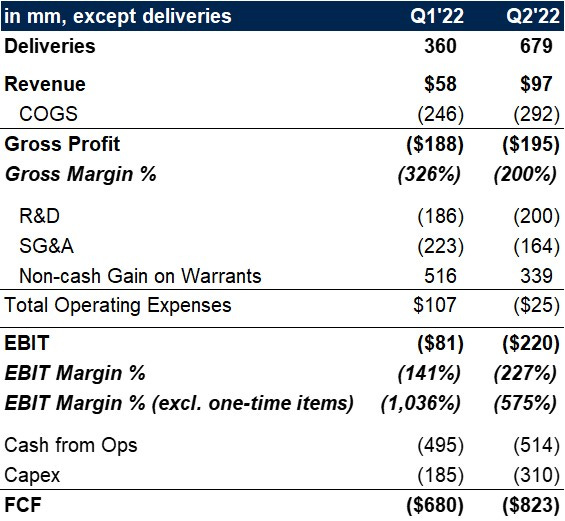

While this article is mostly positive on Rivian, it’s undeniable that their financials are an issue. Rivian has burned over $3B of cash in the first six months of the year and cash burn increased slightly in Q2, despite a big sequential jump in deliveries. Gross margin of -193% also stands out. Even if you exclude key overhead (D&A and SBC), gross margin would still be -155%.

The most troubling aspect of Rivian’s financials are the bloated operating expenses. Core operating expenses (R&D + D&A) in Q2 were over $1B per compared to just $364M for Lucid. Rivian absolutely needs to get operating expenses under control if they want to succeed. The company is taking the right steps to address this and recently announced it would be laying off 6% of its workforce.

While this level of cash burn is a negative, it’s understandable for two reasons.

First, with roughly 14,000 employees today, Rivian has clearly pulled forward many of its investments in employees and infrastructure. Rivian doesn’t need 14,000 employees to make and sell 25,000 cars this year. For context, Tesla delivered ~22,500 cars in 2013 and had ~4,400 employees halfway through that year. Of course, Tesla is very unique and shouldn’t be compared to Rivian at this stage, but commentary from management confirms Rivian’s strong belief they can scale revenue significantly faster than headcount going forward.

Second, Rivian is ramping several vehicles at once. This has its pros and cons. It’s beneficial because it gives Rivian a first-mover advantage across multiple market segments, diversifies their product lineup, advances their scale relative to other EV startups, and gives them the opportunity to work with great partners like Amazon and Mercedes. But ramping multiple vehicles obviously has a negative initial financial impact, which we’re seeing here. There are also valid concerns around lack of organizational focus on just 1-2 products given the difficulty in scaling production.

Rivian’s cash burn is more palatable because of its strong cash position. Despite a higher burn rate than Lucid, Rivian has much longer runway with its existing balance sheet. It’s still very early for Rivian and its financial profile should improve as production ramps. For context, management is targeting 25% gross margins and 10% free cash flow margins, which is obviously years away, but still achievable longer term.

Lucid

Below are Lucid’s key financial metrics.

Unsurprisingly, Lucid is also deeply unprofitable as it ramps initial vehicle production. YTD cash burn of ~$1.5B is only half that of Rivian, which is positive, but the main concern is production growth.

Similar to Rivian, I believe Lucid’s unit economics will improve dramatically if it can scale production. The key difference is that Lucid is struggling significantly in this area. In fact, Lucid has cut its FY22 production target twice since March, going from 20,000 units to now 6,000-7,000 units.

Conclusion

Both companies clearly need to improve their cash burn and capital efficiency. The good news is that operating expenses for both companies fell sequentially in Q2 vs Q1, despite significant increases in production and deliveries. Rivian is burning roughly double the amount of cash as Lucid, but is also investing more aggressively in building out its infrastructure and product pipeline.

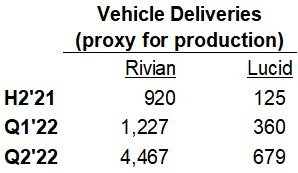

Given each company’s massive order backlog, the most important metric to follow is production. While Lucid has cut its FY22 production forecast twice, Rivian has maintained the same 25,000 unit goal the entire year. The delivery data below is the best proxy for production since Lucid hasn’t disclosed quarterly production figures.

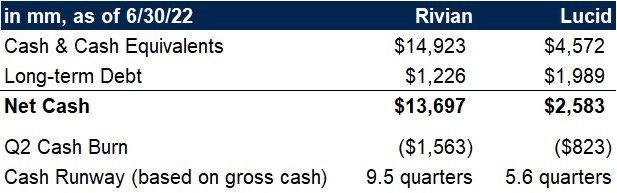

After production growth, one of the most important factors to evaluate is each company’s cash position, which is a critical buffer to de-risk operations. This is another area where Rivian has a clear advantage.

As of Q2, Rivian had $13.7B in net cash compared to $2.6B for Lucid. Ignoring debt (given the long-dated maturities) Rivian has 9.5 quarters of runway at its current burn rate, while Lucid only has 5.6 quarters.

Unsurprisingly, Lucid just announced an $8B shelf to improve its liquidity position. A shelf is a vehicle to raise funds in the future (nothing has been raised yet), which will dilute shareholders and put selling pressure on Lucid’s stock over the coming quarters.

One notable aspect of the financial comparison is the difference in average selling prices (ASPs). Lucid’s ASPs are 76% higher than Rivian’s, yet Lucid has lower gross margins. Lucid also has the benefit of a simpler product lineup, as Rivian is suffering from production inefficiencies trying to ramp three separate models. As mentioned in the product section, Lucid’s ASPs are set to decline materially once initial premium variant orders are fulfilled. Conversely, Rivian’s Q2 ASP of $81.5k is more sustainable given the lack of cheaper options becoming available for the foreseeable future.

Taking everything into consideration, it’s surprising that Lucid’s market cap is this close to Rivian’s.

When factoring in net cash, Rivian is cheaper on a total enterprise value basis. Rivian’s valuation discount is amplified when looking at revenue multiples (3.3x FY23 revenue compared to Lucid at 8.0x). I’m not a fan of revenue multiples, but it’s a useful data point here given the lack of profitability for both companies. I’m also more confident in Rivian hitting their 2023E revenue estimate than Lucid hitting theirs.

Summary

I’m neutral on RIVN as a standalone investment, but believe RIVN will outperform LCID from here. Compared to Lucid, Rivian has a stronger:

History of execution and maintaining guidance

Production and sales track record

Balance sheet and net cash position

Existing product offering and backlog

Future product roadmap

Addressable market opportunity

Management continuity

Set of investors and strategic partners

In my opinion, Lucid is a lower-quality company and will be facing several near-term headwinds. Over the next year, Lucid will be:

Raising up to $8B that will dilute existing shareholders and cause downward selling pressure on the stock

Building out second factory in Saudi Arabia, despite not yet figuring out production at existing AZ factory

Selling at lower ASPs as initial premium variant orders are fulfilled. Current ASP of $143k is unsustainable

Not releasing any new models outside of different Air variants. Gravity SUV is multiple years away and still a niche and luxury product

As discussed in the intro, both companies have strong potential in a massive addressable market with structural advantages over legacy automakers. With that said, there’s a long road ahead for both Rivian and Lucid. It’s possible that neither company sufficiently ramps production or achieves positive free cash flow. Even if they achieve these goals, it’s possible the stocks are dead money for several years given the elevated valuations today.

It will be important to follow both companies closely given the extremely wide distribution of outcomes for shareholders.

Disclaimer: This is not financial advice and has been prepared for informational and educational purposes only. The writing contains certain forward-looking statements and opinions, which are subject to unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. Readers should conduct their due diligence and make their own investment decisions.

Great write-up with an unsurprising conclusion. Thank you very much.

Rivian seems like a high risk, high reward investment at that point, but I believe their future is bright and that they have a great product.