The Auto News Update concisely reports and reacts to key developments in electric vehicles and new technology in the auto sector. I post this news update weekly in addition to fundamental investment research. If you’re interested in this topic, please consider subscribing!

This update will cover:

Volkswagen CEO Herbert Diess is leaving the company

Amazon begins delivering packages with Rivian vans

Ford secures raw materials for EV production

Tesla releases V4 Supercharger design

CATL choosing between Mexico locations for a new battery facility

GM unveils the Cadillac Celestiq

Volkswagen CEO Herbert Diess is leaving the company

News: On July 22, Volkswagen announced that its CEO Herbert Diess will be stepping down on August 31st and will be replaced by the CEO of Porsche (another VW brand), Oliver Blume. This move comes at a critical time for VW given their plans to separate Porsche into a separate public entity, which is planned for Q4 of this year, and the massive overhaul required to transition production to EVs.

My reaction: This is a big hit to VW’s EV efforts given Diess’ instrumental role in pushing VW towards electrification. For context, VW produces more EVs than any other legacy OEM today.

While this move comes as a surprise to many, there have been many publicized instances of internal conflict leading up to this. VW’s board revoked some of his authority in December 2021, but ultimately decided to keep him as CEO, after a dispute with unions following Diess’ comments that VW may have to lay off 30k workers if they don’t transition to EVs fast enough. More recently, as I reported last week, VW experienced significant delays to production targets as a result of its software division, Cariad. This division was led by Diess and was apparently the final straw for VW’s board that led to their decision to part ways.

This internal power struggle really underscores the difficulties that legacy OEMs have in the transition to EVs. There are too many stakeholders, including legacy family shareholders, unions, and dealerships, that all have different incentives and will ultimately delay the pace at which these companies can innovate.

Amazon begins delivering packages with Rivian vans

News: On July 21, Amazon CEO Andy Jassy announced that his company had begun delivering packages with Rivian’s electric vans. For context, Amazon initially invested in in Rivian in February 2019 and ordered 100k vans later that year. Amazon originally planned to use these vans in 16 cities by the end of 2021, but Rivian’s production ramp has been slower than expected, which isn’t too surprising for a new EV startup.

My reaction: The Amazon partnership is undoubtedly a great thing for Rivian. In addition to the unit orders, Amazon helps validates Rivian’s technology and EVs in general by using their vans for high volume package deliveries across the country. Amazon can also provide additional capital in the event that Rivian needs more liquidity in the future. However, the partnership does add some complexity to their production ramp, as Rivian has to focus on multiple vehicle platforms during its initial production ramp. It will be interesting to see how Rivian balances scaling its consumer products (R1T now and R1S later this year) while simultaneously building vans for Amazon.

Ford secures raw materials for EV production

News: On July 21, Ford issued a press release updating their plans to source raw materials to meet their EV production targets. The company has secured contracts to deliver 60 GWh of annualized battery capacity by the end of 2023 for the Mach-E, F-150 Lightning, and E-Transit. One thing that’s commonly misreported here is their actual production targets. Their forecast is annualized capacity of 600k EVs at the end of 2023, and annualized capacity of 2M EVs at the end of 2026. This does not mean they will produce or delivery those quantities in those years. Regardless, these targets are more ambitious than most other legacy OEMs and securing the raw materials is a positive development for Ford.

My reaction: Over the past year, Ford’s CEO Jim Farley has clearly demonstrated that he understands the challenges to ramping EV production, and sourcing raw materials is a critical component. This level of forward-thinking separates Ford from many other legacy OEMs who don’t have as defined of an EV production roadmap.

Tesla releases V4 Supercharger Design

News: On July 19, Tesla submitted designs for its next-gen V4 superchargers. This design looks very similar to the Megachargers Tesla installed at Frito-Lay in January for the Tesla Semi, which the company plans to begin producing next year. While the design itself is different, the key update is the increase in charging rates. The V4 charger is expected to provide a max charging rate at least 350kW, which is a big step change from the V3 superchargers currently providing max rates of 250kW. For context, the V3 superchargers add ~200 miles of range in just 15 minutes.

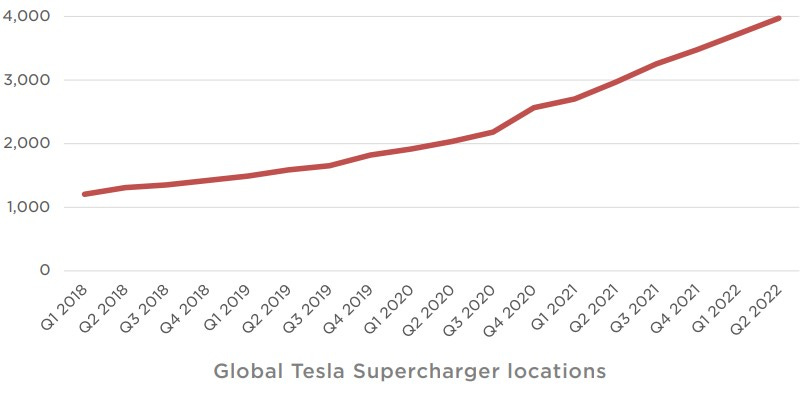

My reaction: It’s no secret that Tesla’s supercharger network is the largest and most reliable fast charging network in the world, but many are unaware of how much the company is growing and innovating this service. Since the end of Q1’18, Tesla has increased the number of supercharger locations from 1.2k to 4k worldwide. The growth in infrastructure and increase in charging rates should help prepare for the wider opening of Tesla superchargers to other car brands across the U.S. later this year, which has already happened across Europe. There are valid concerns that expanding the supercharger network to non-Tesla customers will diminish the experience for Tesla customers if they have to wait to charge, so the expansion will be interesting to follow.

Tesla also reported its Q2 earnings on July 20th. This quarter was an anomaly for many reasons, including their primary facility being shut down for half the quarter due to Covid lockdowns in China, so the market was mostly focused on the go-forward outlook. Since the report, analyst estimates have increased for both FY22 and FY23 given the upbeat guidance and strong profit beat in Q2, as the company is well-positioned to generate record operating margins excluding credits in Q3 and going forward. I summarized my takeaways here.

CATL choosing between Mexico locations for a new battery facility

News: On July 17, Bloomberg reported that CATL is actively evaluating different locations in Mexico for a new battery factory and plans to invest $5 billion in this project. This factory will supply both Tesla and Ford and is going to potentially be split into both a Mexico and US location.

My reaction: This is a material development for EV adoption. As I’ve said many times, EV volumes are 100% reliant on supply for many years, not demand. The supply chain, particularly EV batteries, will determine how many EVs are made and this is a bullish indicator given CATL’s position as the world’s largest producer of EV batteries today. This also comes after other key battery suppliers, including Panasonic and LG, announced significant investments and new facilities last month.

GM unveils the Cadillac Celestiq

News: On July 22, GM officially unveiled the Cadillac Celestiq, an upcoming EV model that’s currently planned to start production in late 2023. This will reportedly cost around $300k, though official pricing has not been disclosed.

My reaction: This will help showcase the capabilities and performance of an EV vs a traditional ICE vehicle to GM’s customer base. However, the $300k price tag means this will be sold in incredibly low volumes. This won’t move the needle for GM and I’m skeptical of their ability to scale EV volumes while offering so many different models. They’ve already had significant issues with existing models, including the Bolt, which had to stop production for 6 months, and the Hummer, which started production in December yet GM is reportedly still only making 12 units per day. Instead of focusing on making a few compelling products and scaling those, they want to offer 30 different models by 2025. It’s unclear how many of these will actually sell in high volumes, but there’s certainly added complexity that results from producing and selling so many different options, especially if none of them in particular resonate with many consumers.

If you’ve made it this far, please consider subscribing! Thanks for reading

Teslas supercharger ramp rate is impressive, but nowhere near the growth rate of their vehicle sales. Hope to see them increase the build rate much faster; this will not only ensure Tesla owners are covered but also secure Tesla superchargers as the de-facto standard for the US. The Government will then have no choice but to cooperate with Tesla rather than subsidize a competitive network, especially once Tesla opens their network to all EVs.