Auto News Analysis #4

Analyzing developments on Hertz's EV fleet, Lucid, Ford, BMW, Toyota, and Nikola

Auto News Analysis concisely analyzes key developments in electric vehicles and new technologies in the auto sector. I post this update weekly in addition to fundamental investment research, all for free. If you’re interested in this topic, please consider subscribing!

This update will cover:

Hertz highlights commercial use cases for EVs

Lucid cuts FY22 production guidance

Ford discusses Mach-E production rates

BMW doubles down on hydrogen fuel cells

Toyota struggles with initial EV production

Nikola announces deliveries and acquisition of Romeo Power

Hertz highlights commercial use cases for EVs

News: On July 28th, Hertz announced Q2 results and commented on the performance of its EV fleet. Last October, Hertz announced its intention to buy 100k Model 3s and their fleet already includes 20k EVs today, the majority of which are Teslas. Management’s commentary shows they’re very pleased with the results so far:

EVs require only 50-60% of the maintenance costs that ICE vehicles require

EV depreciation is not only lower than ICE vehicles, but also lower than what Hertz originally forecasted

EVs have NPS (customer satisfaction) scores that are 10 points higher than Hertz’s global average

Hertz is more confident than ever about the commercial use cases for EVs and will continue to grow its EV fleet

My reaction: This really underscores some of the reasons why I started this substack in the first place. People aren’t just buying EVs because they’re better for the environment. When made properly, EVs have better performance and handling, helping drive higher customer satisfaction ratings, while also offering lower total cost of ownership (both maintenance and fuel) and lower depreciation than comparable ICE vehicles.

EV share is also growing in ride sharing, another commercial use case. Uber reported its Q2 earnings on August 2nd and noted that share of EV miles has increased to 6.2% in Europe and 2.6% in the U.S. This has a compounding effect because the more commercial use cases for EVs, the more consumers will experience and ultimately consider buying an EV for the first time.

Lucid cuts FY22 production guidance

News: On August 3rd, Lucid reported Q2 earnings and cut full-year guidance from 12-14k units to 6-7k units due to “extraordinary supply chain and logistics challenges.” In H1’22, Lucid burned $1.5B of cash while producing and selling 1,405 and 1,039 units, respectively. Lucid’s stock fell -9.7% on Thursday in response to the earnings report.

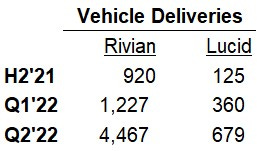

My reaction: This has been a rough year for Lucid. When Lucid raised $4.5B through a SPAC in 2021, the company projected 20k deliveries in 2022. In March, their guidance changed from deliveries to production, an easier bar to clear, and the forecast was cut to 12-14k. After cutting its forecast again just 5 months later, this time by 50%, Lucid is clearly struggling and losing credibility with the market. Lucid’s deliveries are falling further behind sales of Rivian, who has a similar valuation and also started production late last year.

While Lucid struggles with production at its Arizona facility, the company is already building another factory in Saudi Arabia, which isn’t ideal. I won’t go into more detail here since I’m already working on a deep dive comparing Lucid and Rivian. This will be posted for free in about a month, so stay tuned.

Ford discusses Mach-E production rates

News: On July 21st, a Ford executive discussed the production rate for its flagship EV, the Mach-E: “In our Cuautitlan (Mexico) facility today where we make the Mach-E, we make about 2k Mach-Es a week. Demand clearly exceeds that and when we change over our plant next year we will accelerate very quickly to about 4k per week.”

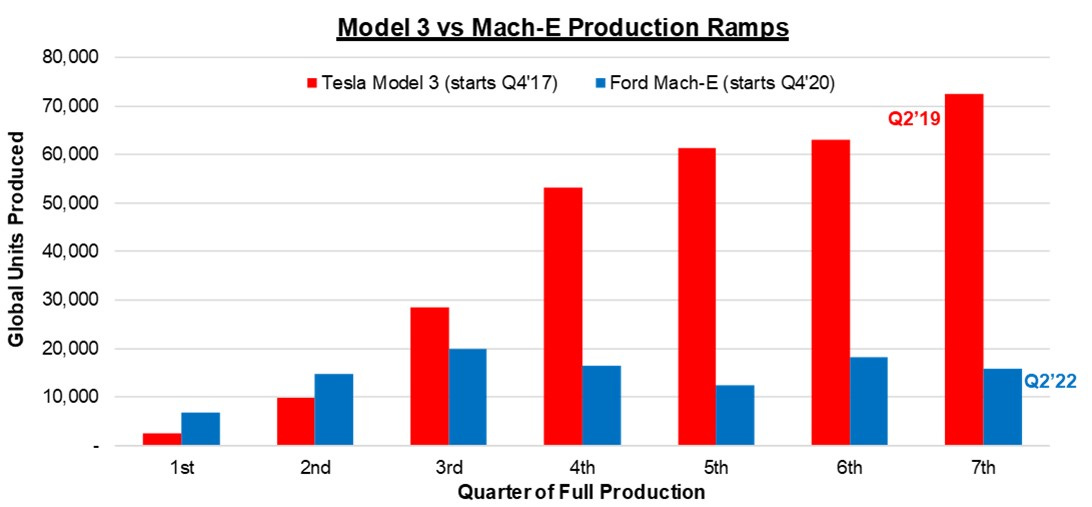

Ford initially began Mach-E production in October 2020 and built ~64k units in 2021. Production peaked in Q2’21 and has leveled off since, as H1’22 production of ~34k units is down -2% YoY.

My reaction: Capacity of 2k Mach-Es per week is pretty strong, but Ford still hasn’t produced more than 20k in any given quarter. Some are comparing the Mach-E ramp with Tesla’s Model Y ramp, which started just 9 months earlier, but I think that’s an unfair comparison. The Model Y was Tesla’s second mass-market vehicle and shares ~75% of the same parts as the Model 3, so it should ramp quicker than the Mach-E. I think the right comp is against the Model 3. There’s some nuance given Covid and associated supply constraints for Ford, but it’s still a useful comparison.

This ramp is disappointing and the recent start of F-150 Lightning production will add complexity. Ford will need to ramp both vehicles much quicker in order to achieve its goal of 600k annualized capacity by the end of 2023. However, Ford seems more focused than ever and is clearly better positioned than most other legacy OEMs.

BMW doubles down on hydrogen fuel cells

News: On August 3rd, CEO Oliver Zipse said BMW is continuing to invest in hydrogen fuel cell technology: “If we run into an emission-free world, you have to have an offering of hydrogen. Otherwise, you will lose market share” This comes months after re-affirming their target to begin producing the iX5, a hydrogen powered vehicle, in the next year.

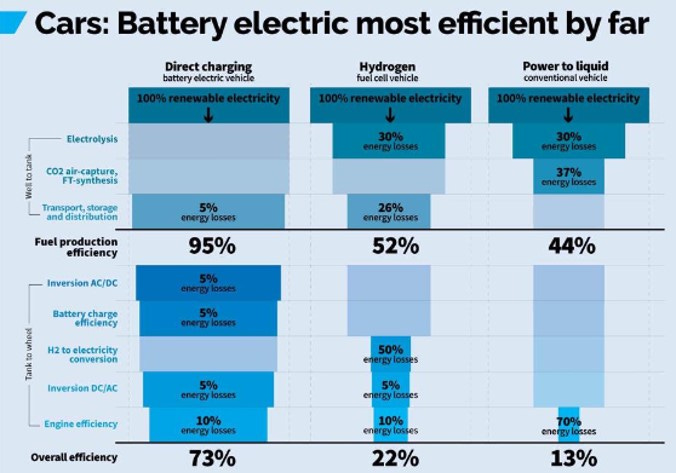

My reaction: This isn’t surprising given BMW’s continued support of hydrogen vehicles, but it still makes no sense. Hydrogen is significantly less efficient than battery electric vehicles (“BEVs”), especially for passenger cars. Hydrogen could make more sense for some heavy-duty applications, but that’s a different discussion altogether. Hydrogen is also more dangerous because its flames are nearly invisible, so people nearby may not even know there’s a fire.

BMW and a handful of other OEMs like Toyota seem to be suffering from sunken cost fallacy, while energy experts and auto executives like Herbert Diess have already dismissed fuel cells. Then there’s Tesla and leading startups like Nio and Rivian who are all solely focused on BEVs, which allows them to improve this technology faster than peers that are experimenting with less efficient drivetrains. Being pulled in several different directions, while also investing in their legacy ICE divisions, puts companies like BMW and Toyota at a disadvantage.

Toyota struggles with initial EV production

News: Speaking of Toyota, on August 4th, the company began offering customers the option to buy back the EVs customers purchased. This comes after the vehicle (called the bZ4X) was recalled in June, just two months after deliveries began, due to risks the wheels may fall off. The bZ4X is Toyota’s first ever fully-electric car.

My reaction: While recalls are very common in the industry, this isn’t a typical recall. Toyota still has no solution for this issue and continues asking customers not to drive the cars entirely. That’s a big problem that likely wouldn’t happen with its gas-powered cars. While wheels falling off may not seem an EV-specific issue, Toyota experienced the same issue with the Solterra, another EV that was jointly developed with Subaru. This is another example of legacy OEMs struggling with EV production, this time from Toyota, the largest OEM by volume today (~10M units annually).

Nikola announces deliveries and acquisition of Romeo Power

News: On August 4th, Nikola reported Q2 earnings and announced it delivered 48 units of its Tre BEV commercial vehicle after starting production in March.

Separately, on August 1st, Nikola agreed to acquire Romeo Power, a manufacturer of lithium-ion battery modules, in an all-stock deal that values Romeo’s equity at ~$144mm. At one point, Romeo had a $5.8B market cap.

My reaction: While I remain highly skeptical of Nikola, it’s great they were able to finally begin production ~1.5 years after disgraced founder Trevor Milton stepped down. The company still has a long way to go, but it’s a start.

Usually I wouldn’t cover a deal this small, but there’s a unique aspect of this agreement. Given Romeo’s liquidity issues, Nikola is providing temporary debt funding and product incentives prior to close, even if Romeo doesn’t reach its targets (more info here). This is especially interesting because Nikola accounted for 62% of Romeo’s revenue in 2021.

Romeo was in a very desperate position: significant liquidity needs and customer concentration. But instead of letting Romeo proceed with bankruptcy, Nikola bails them out and provides temporary funding before close. Clearly, Nikola was also desperate and dependent on Romeo as a supplier, which highlights the difficulties of the supply chain. I’m highly skeptical of the anticipated annual cost savings of $350mm by 2026 and think this is a defensive move from Nikola.

I’m shocked that Nikola’s market cap is still ~$3.5B and will continue covering key developments at the company.

If you’ve made it this far, please consider subscribing or sharing! Thanks for reading

Just checked out @nikolamotor Twitter feed. Huge red flags imo. Nearly all posts plead with shareholders to vote to increase share count so they can raise more funding. The few tweets about actual products refer to “pilot” programs and shipments to dealers. Nothing about sales to actual customers.

Appears that all 48 tre’s were delivered “to dealers” so not actually sold. Question is, will there ever be real buyers? I suspect they are taking whatever steps necessary to keep up the appearance of a going concern until management stock options vest in June 2023. After that the company implodes.