Understanding Tesla's operating leverage

How Tesla quickly became the highest margin auto OEM and is likely to grow this lead

Today, Tesla enjoys the benefit of being a first mover in the EV space. Longer term, however, this advantage will slowly diminish and the company will need to maintain its cost advantage in order to achieve its goal of selling more vehicles, at higher profit margins, than any other OEM globally. For context, the two largest OEMs by volume are Toyota (~10.5M units) and Volkswagen (~8.5M units), compared to Tesla at 1.1M units in the past year. While Tesla has increased prices several times recently in response to demand exceeding supply, they will need to lower prices over time to unlock demand from the vast majority of the market. Right now, the entry-level/zero option versions of the Model 3 ($47k) and Model Y ($66K) are unaffordable for the vast majority of consumers.

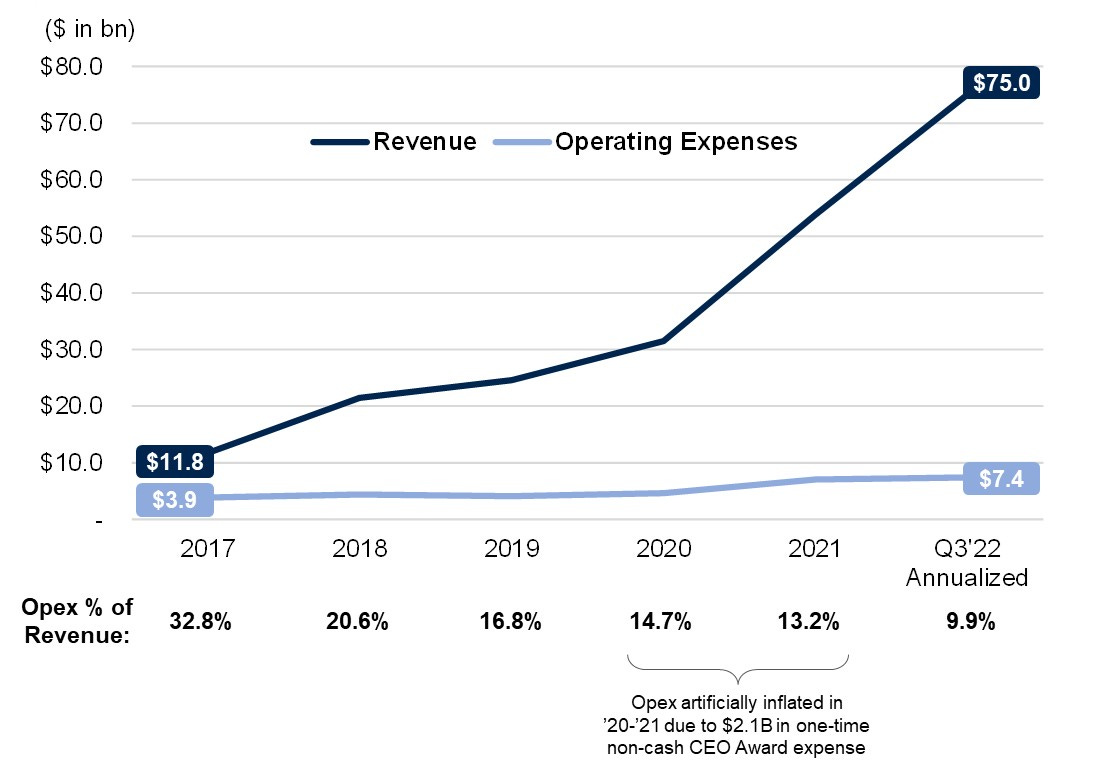

That raises the question: how will Tesla lower prices without depleting profit margins? The obvious answer is to reduce direct vehicle costs, which Tesla has historically executed very strongly on. However, it’s their operating leverage (revenue rising faster than fixed operating costs) that’s accounted for the majority of Tesla’s margin expansion, as Opex has decreased from 32.8% of revenue in FY17 to 9.9% in Q1’22. This post will briefly cover how Tesla has reduced its direct vehicle costs, but mostly focus on how the company achieved such strong operating leverage and why that’s likely to continue going forward.

Direct Costs / Gross Margins

As with any new technology, in this case lithium-ion batteries, the initial costs are extremely high and prohibitive to mass production/consumption. With significant innovation and economies of scale, production costs fall dramatically and the products eventually become affordable to the average consumer. In the past century, there are many examples of this phenomenon (compute power, televisions, telephones, etc.) and electric vehicles are no different. Over the past ~5 years, Tesla has decreased its average selling price by -49%, yet still increased auto gross margins (excl. regulatory credits) from 18.3% to 29.7%, all while improving every aspect of the product (range, performance, software, and build quality).

Advances in battery technology played a critical role in reducing production costs and Tesla expects further cost reduction going forward through its LFP chemistry (used in ~50% of vehicles in Q1’22) and 4680 form factor (just beginning to ramp production). There are a handful of other reasons for Tesla’s gross margin expansion, all of which are also sustainable going forward: economies of scale/raw materials purchasing power, increased factory automation, production efficiencies (i.e. structural packs), and higher mix of software/FSD sales and utilization. VW CEO Herbert Diess has been impressed with Tesla’s production efficiency, stating that VW’s target is to improve their production timeline from 3x to 2x the time it takes Tesla to produce its vehicles. As Diess puts it, “Tesla is the benchmark today.”

Opex / Operating Leverage

Tesla’s ability to reduce production costs has been impressive, but their operating leverage is the most under-appreciated aspect of its business in my opinion. How was this achieved and is it sustainable?

I’ll cover efficiencies across 3 areas: employees, factories, and R&D

Employees:

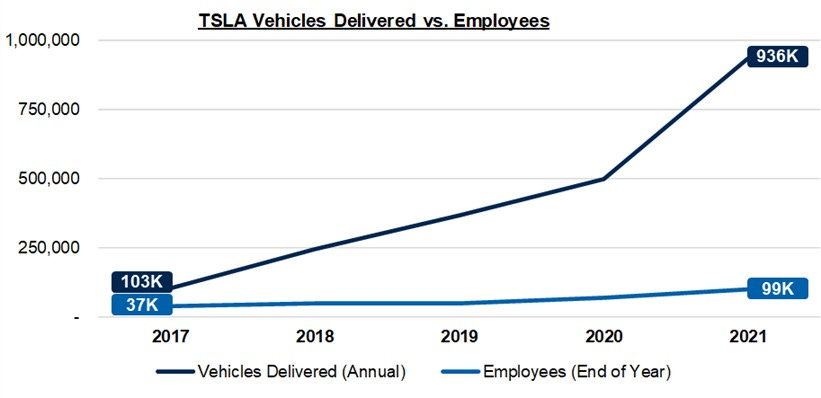

Over the past 5 years, Tesla has grown deliveries by 9.1x while headcount has only grown 2.6x. Higher automation and online sales mix, combined with optimized service (i.e. mobile service), helps the business scale with low incremental labor costs.

As one of the most attractive employers in any industry, Tesla can be more selective and only hire the best/most productive engineers, a trend that’s improved considerably. The number of unique job applicants has increased 4x since 2019 to ~3mm in 2021, and Tesla only hired 1-2% of those applicants.

Given Tesla’s highly productive workforce, the company can afford to periodically cut unproductive staff, as the company recently announced that it would lay off 10% of its salaried workforce, with no impact to production plans. While this is unfortunate for employees, Tesla has consistently optimized its workforce and cost structure (including in 2018 and 2019) without compromising growth.

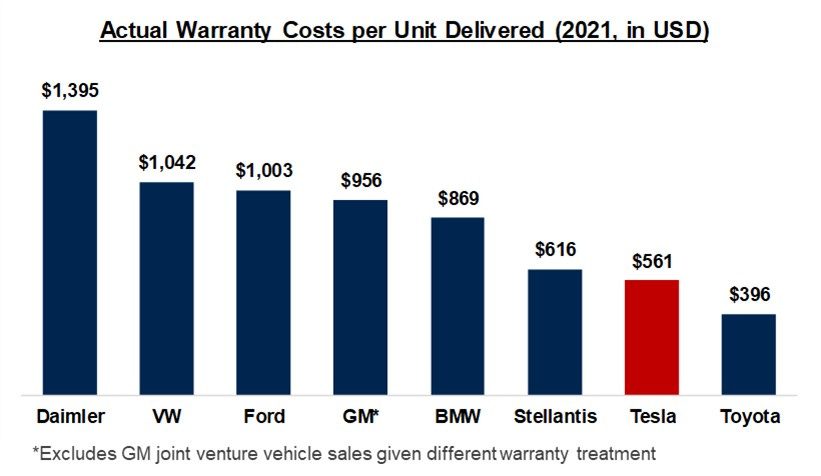

Tesla can also sell more vehicles per service employee, as service needs (and associated cash warranty costs) are declining with improved build quality. In fact, Tesla now has the 2nd lowest cash warranty cost (not warranty reserves) per unit, behind only Toyota. Warranty costs sit within COGS, but lower warranty costs per vehicle is a testament to improved build quality. This trend, along with safer driver-assist functionality resulting in lower accident rates, reduces need for new service employees (within SG&A) as volumes scale.

Factories:

New factories are significantly more efficient than the Fremont factory, which has an outdated layout from the 1960s designed by General Motors for ICE vehicle production. Fremont production was 100% of sales until 2020, and this will likely fall to ~25% by 2023. Capex efficiency has improved dramatically as each factory leverages learnings from older facilities to optimize the layout of each new factory.

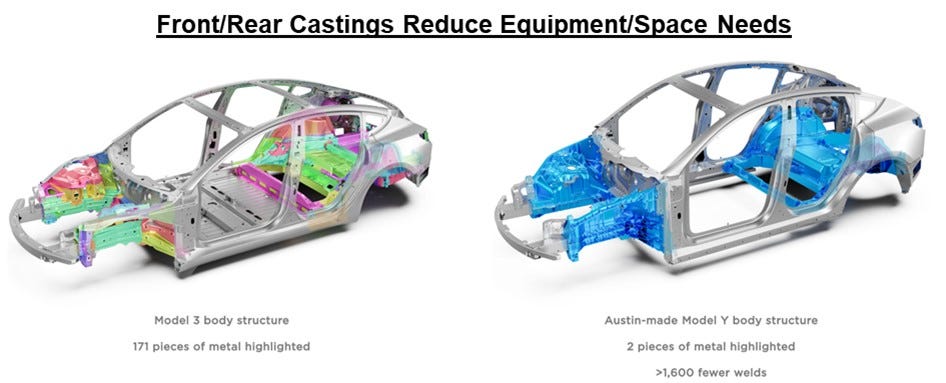

Tesla also continues to innovate its manufacturing process, which now requires significantly less equipment/space/overhead than older facilities. One example is the front/rear casting structure for the Model Y, a new innovation in the Austin and Berlin factories that will result in less incremental investment per unit. Due to several similar innovations, management doesn’t expect capex to materially increase from 2021 through 2024, despite targeting >3x increase in annual vehicle production over this period. As a result of relatively lower capex needs, D&A in the income statement will continue to fall as a % of revenue.

New factories also reduce transit costs (for both raw materials and finished goods) and tariffs because of localized production. The mix vehicles produced and delivered on the same continent has risen from ~50% in 2019 to ~70% in 2021, with a clear path to achieving their long-term target of 100%. This trend will continue lowering transportation costs per unit.

R&D:

Tesla’s R&D budget is unique because it’s mostly either funded by customers or has strong overlap with the auto business. Tesla continues innovating and is well-positioned to expand into massive adjacent markets, despite R&D falling from 12% to 5% of sales from 2017-2021.

The Company’s largest R&D project is its autonomous driving software, Full Self Driving (“FSD”). The technology itself warrants its own discussion, but the focus here is solely about the lack of capital intensity. Not only is Tesla’s FSD development capital-light given its camera-based approach, the company actually receives $12k per customer that opts into its FSD program. Currently, there are over 100k active FSD Beta users logging millions of miles per month in a variety of regions and weather conditions. Every vehicle produced is equipped with the technology needed to activate FSD Beta and receive over-the-air software updates to improve performance over time. This allows the company to significantly scale its fleet and collect high-quality/diverse data with much less capital required than LiDAR-based competitors (i.e. Cruise or Waymo), who only operate <1k cars in a few cities.

Tesla also is well-positioned to become the largest insurance underwriter for Tesla customers. Tesla successfully gamified safe driving by incentivizing users with high Safety Scores with lower insurance rates and FSD access. Through its camera suite and FSD software, Tesla has access to an unprecedented amount of high-quality data at almost no incremental cost. This data is vastly more comprehensive than telematics data obtained by 3rd party insurance providers, and is packaged into an integrated insurance product directly in the Tesla app with real-time feedback. Drivers with a Safety Score between 91-100 are ~45% less likely to be in an accident than drivers with a safety score between 70-80. Just 6 months after state launch, Tesla is already the 2nd largest insurer of Teslas in Texas and expects to become #1 by year-end.

Tesla’s Energy segment (5% of LTM revenue) can also be considered a long-term R&D project given its limited scale today. This also doesn’t require much incremental capital because of its overlap with the auto business. They key to growing energy storage production is scaling 4680 cell production, which is already being developed for Tesla vehicles. Even with a much smaller R&D budget relative to peers, Tesla’s battery technology is more efficient which is a great example of their core engineering advantages.

Conclusion

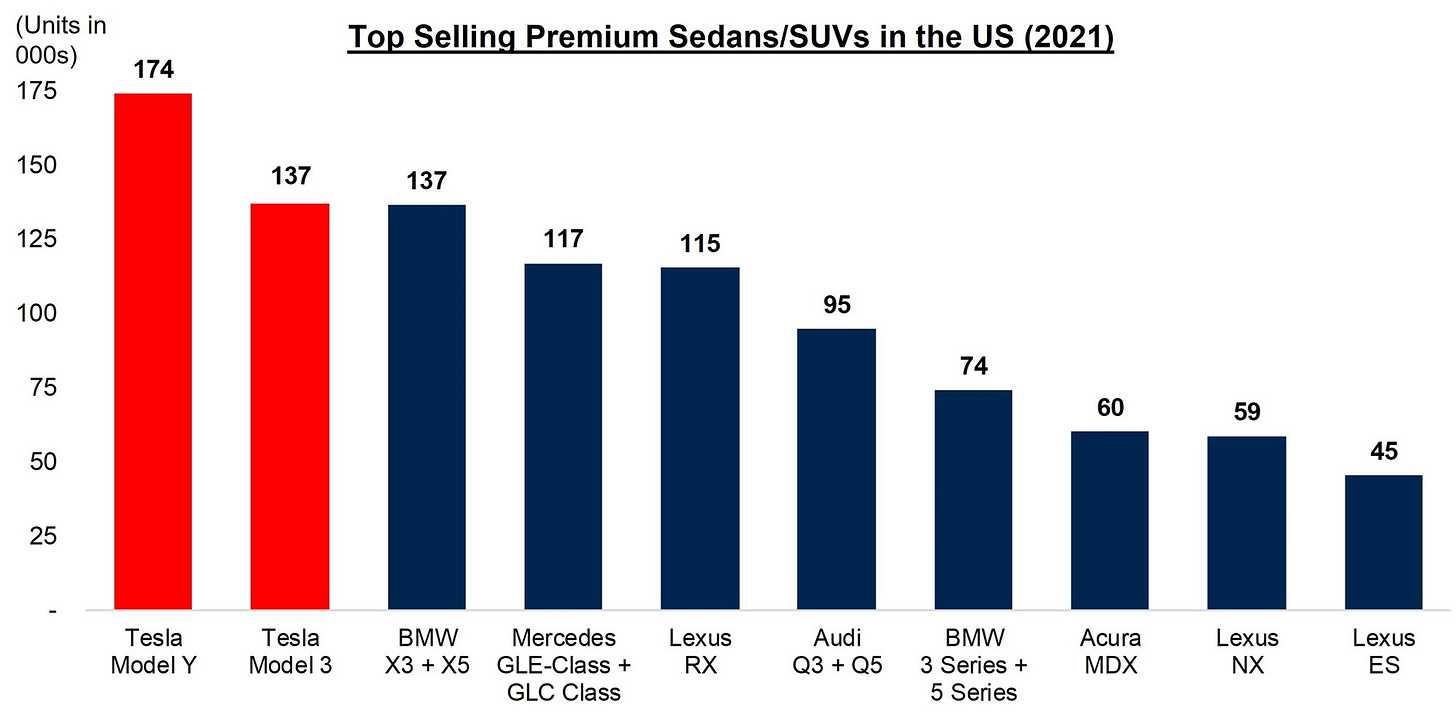

All of these efficiencies have resulted in significant operating leverage that will compound with higher unit volumes. Once production ramps, Tesla can lower the prices of its vehicles, making them more affordable for the average consumer, while also expanding profit margins. Today, despite only ~4% EV share in the US, Tesla has the #1 and #2 spots in the US luxury sedan/SUV market (for any car, not just EVs). Given their leading position in the higher-end luxury segment and record-high customer satisfaction ratings, Tesla has a clear path to take significant share in larger, more affordable segments of the market.

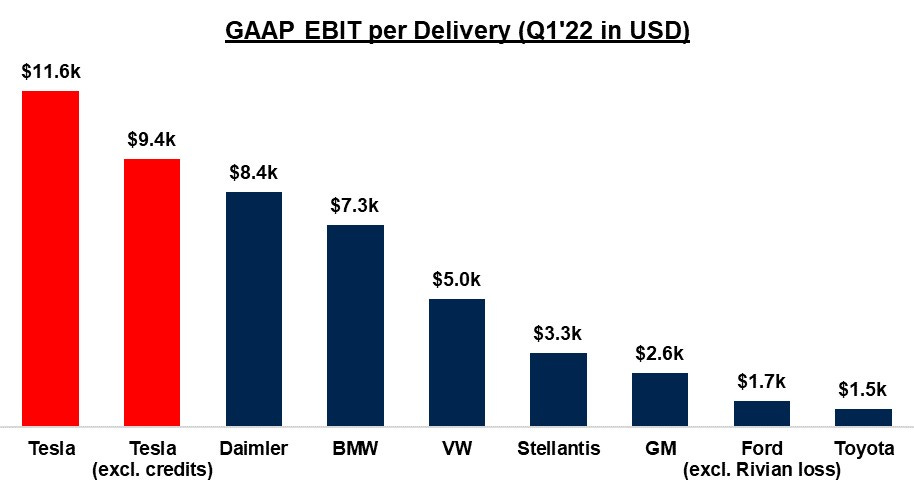

While Tesla’s unit economics are already best-in-class and continue to improve, legacy OEMs are facing diseconomies of scale as their core business (ICE vehicles) is in secular decline. EVs require significant upfront investments and are more expensive to produce, thus hurting legacy OEM profitability. Additionally, Tesla has structural business model advantages due to integrated distribution and supply chains, higher battery efficiency, stronger raw materials sourcing capabilities, larger EV scale, and lack of pension/union liabilities.

Going forward, it will be nearly impossible for any OEM to become cost-competitive against Tesla. The most important aspect of maximizing demand for your cars is affordability, and Tesla has a clear advantage over its peers. This will become more apparent once legacy OEMs begin separating its financials for electric vehicles starting next year.

If you’ve made it this far, please consider subscribing and feel free to provide feedback! Thanks for reading

This is great! Will pick it up in my weekly mobility briefing for German automotive & mobility professionals, if that’s ok:

www.allaboutmobility.de

Thanks, that was great content. Prime example of Economies of Great People attracting Great People. In the meantime VW has another CEO.