Auto News Analysis #3

Analyzing developments on the EV tax credit, VW, Cruise, and Tesla

The Auto News Update concisely reports and reacts to key developments in electric vehicles and new technologies in the auto sector. I post this news update weekly in addition to fundamental investment research. If you’re interested in this topic, please consider subscribing!

This update will cover:

New EV tax credit bill is proposed

Volkswagen starts ID.4 production in Chattanooga

GM discloses Cruise financials

Tesla expands production in Berlin

New EV tax credit bill is proposed

News: On July 27, a new climate bill was proposed by the Senate, which includes a $7,500 tax credit for buyers of new EVs and a $4,000 credit for used EVs in the U.S. Both vehicle OEMs and buyers need to meet different criteria in order to qualify. This includes retail prices (i.e. under $80k for SUVs and pickup trucks, under $55k for sedans), battery materials sourcing requirements that becomes stricter over time, and income limits for buyers. In addition to the consumer EV incentives, there are also tax credits for commercial vehicles, solar, and energy storage products. The bill itself is 725 pages with more details than I can cover here, so I’d recommend watching this excellent video summary if you’re interested in learning more.

My reaction: I think this bill is excessive and focused on the wrong incentives. An unlimited tax credit for 10 years could cost the U.S. upwards of $1 trillion, despite already strong organic demand for EVs. The U.S. should instead focus on investing in the raw materials supply chain, which will be the biggest limiting factor to EV adoption going forward.

My biggest issue with this bill is the minimum requirement for a battery pack size is only 7 KWh, which provides just ~25 miles of battery range. That means OEMs can make a predominantly gas-powered “hybrid” vehicle with a small battery that only costs them ~$1k and still get the full $7.5k credit! Not only is that a waste of taxpayer money, but it completely dis-incentivizes actual EV production as legacy OEMs can continue making ICE vehicles and still get massive subsidies. At the very least, the credit should be lower for hybrids compared to fully electric vehicles.

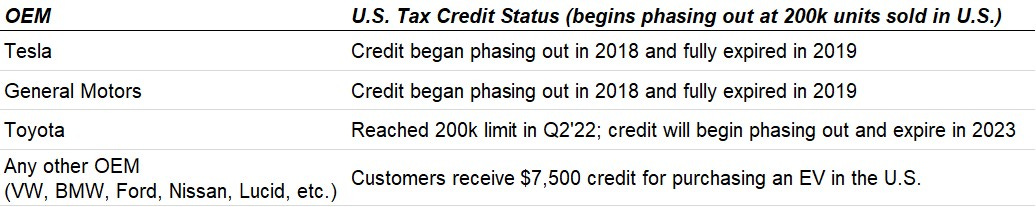

Legacy OEMs stand to benefit the most, as this will help them finally sell EVs at a profit by raising prices to offset the consumer credits. Even with a similar $7,500 credit today, Ford admits they still sell EVs at a loss. Legacy OEMs need the incentives more than Tesla, who only sells EVs and already has industry-leading operating margins and very strong organic demand, before any tax credits. However, this bill does even the playing field for both Tesla and GM, who don’t receive any tax credits today after passing the 200k unit limit years ago. Below is a breakdown of which OEMs already benefit from a U.S. tax credit today, which is different from the ZEV credits often discussed in Tesla’s financials.

While the bill may be excessive, I’m happy to see that it doesn’t favor union-made vehicles. In prior versions of the bill, unionized companies making EVs (even in Mexico) would qualify for more U.S. tax credits than non-unionized companies making vehicles 100% in the U.S. This obviously had no merit and it’s good to see Senator Joe Manchin shoot down such a proposal.

Volkswagen starts ID.4 production in Chattanooga

News: On July 26, Volkswagen announced that it started production of the ID.4 SUV at its Chattanooga, TN facility. The ID.4 is the company’s best-selling EV, but VW hadn’t produce any in the U.S. until now. VW’s goal is to exit 2022 producing 7,000 units per month and increase output further in 2023.

My reaction: This is a big development for VW, as their U.S. EV presence has been very underwhelming. Only 4.4k ID.4s were sold in the U.S. in H1’22, which is a -29% YoY decline. This is clearly a production issue, not due to lower demand, so VW has a path to significantly increase U.S. EV sales with new production in Tennessee. Their goal of 7,000 monthly run-rate implies a quick ramp-up so it will be interesting to track their progress, especially under new leadership.

GM discloses Cruise financials

News: In GM’s July 26 earnings report, the company disclosed financials for Cruise, which is a separately operated self-driving technology company that GM owns ~80% of. Cruise burned ~$800mm of operating cash flow in the first half of 2022 before capital expenditures and various media outlets have reported that Cruise has burned $5 billion since 2018.

My reaction: These financials aren’t surprising but it’s great to have more transparency here. Investors have long wondered what cash burn looks like at self-driving startups like Cruise and Waymo and this gives us some helpful data points. Cruise only began offering paid rides in June, which obviously limits revenue generated in the quarter, so it’s possible that GM begins disclosing these financials more regularly going forward.

I don’t expect Cruise to generate material revenue for several years and positive cash flow won’t come until well after that, if ever. While the ability to offer paid rides is a great achievement, the company still operates under several restrictions: Cruise’s fleet is just 30 vehicles and can only operate in ~30% of San Francisco and only between 10pm and 6am. In general, LiDAR-based systems are very costly and difficult to scale and only a handful of areas are even in the testing phase today. Regardless, offering fully driverless rides for consumers is a big milestone and a step towards adopting Level 5 autonomous vehicles, which I think will be one of the most important technologies of this century.

As more financial data is disclosed from Cruise and competitors, I’ll be sure to cover that here.

Tesla expands production in Berlin

News: On July 27, teslamag.de reported that Tesla plans to increase production of the Model Y in its new Berlin factory to 1,500 units per week in August and 3,000 units per week in October. The report, which was sourced from Tesla employees in Germany, claims that Tesla officially restarted production on 7/25 after two weeks of downtime to upgrade production quality and expand capacity. In June, Tesla hit a peak production rate of 1,000 units per week and on the company’s Q2 earnings call, management noted its goal of producing 5,000 units per week by the end of 2022.

My reaction: It’s good to confirm the planned 2-week facility upgrade, which was originally reported in July, is now complete. This sets Tesla up to potentially reach its goal of exiting Q4 at a 5,000 weekly run-rate, which is critical to expanding share in the European market. There are two important aspects of this story to analyze.

First, why did Tesla need to upgrade Berlin just ~4 months after starting initial production? This could be due to a higher-than-average defect rate with initial production units, which was reportedly fixed in this upgrade. It’s unclear exactly what led to such a quick shutdown, but it’s unlikely Tesla had planned for any downtime before transitioning production from 2170 to 4680 vehicles with structural packs. Tesla just produced the first Berlin-made Model Y with these new innovations in July, but this looks more like a test run than a real production ramp.

Second, how does this production ramp compare to Shanghai? Tesla’s Shanghai facility, which began customer deliveries in January 2020, was the first factory that Tesla designed and built itself. As a result, this has become the benchmark for the company’s production ramps and Berlin has definitely been slower out the gate. However, it looks like Berlin is only a quarter behind Shanghai’s initial ramp and is catching up quickly. If Tesla can average ~3,000 weekly production in Q4 (plusas suggested by this week’s report, Berlin is very well-positioned to match Shanghai’s trajectory. This would be a very positive development that not many are expecting at this point.

Note that Tesla’s production by facility isn’t publicly disclosed outside of China, so we’ll have to wait for more management commentary to better understand how Berlin’s production ramp is progressing.

If you’ve made it this far, please consider subscribing! Thanks for reading

Great insights and very much focused on the most important points, without rambling. Very happy, that I discovered this

Analytical insight into what matters. Good job!