Auto News Analysis #5

Analyzing developments at Rivian, CATL, Tesla, Baidu, and the California EV market

Auto News Analysis concisely analyzes key developments in electric vehicles and new technologies in the auto sector. I post this update weekly in addition to fundamental investment research, all for free. If you’re interested in this topic, please consider subscribing!

This update will briefly cover:

Rivian reports Q2 earnings

EV Tax Credit passes the Senate and the House of Representatives

Supply chain updates from CATL and Tesla

Baidu receives approval for driverless taxi rides

EV market share rises rapidly in California

Rivian reports Q2 earnings

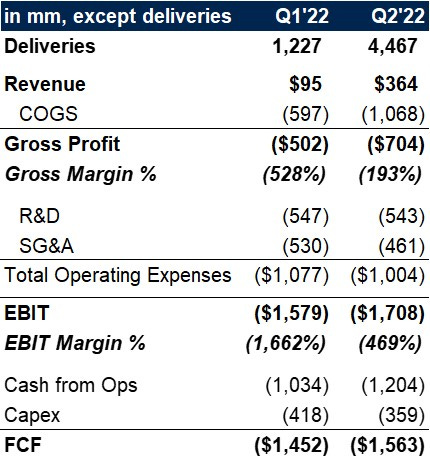

News: On August 11, Rivian (NASDAQ:RIVN) reported Q2 earnings and re-affirmed its FY22 production guidance of 25k units. Q2’22 deliveries grew to ~4.5k units from ~1.2k in Q1’22, while cash burn jumped modestly from ~$1.5B to ~$1.6B. Rivian did update full-year guidance for capex (from $2.6B to $2.0B) and for Adj. EBITDA (from -$4.75B to -$5.45B). Rivian’s stock was roughly flat on Friday in response to the report.

My thoughts: Rivian re-affirming full-year production guidance was the key takeaway. This was especially important after Lucid cut its guidance twice since March, including during its Q2 earnings report. Another EV startup, Polestar, also cut its full-year guidance in May. While still early, Rivian’s production ramp has been impressive, which is one of the reasons I believe they are the best positioned U.S. EV startup. It’s respectable that they haven’t used the supply chain as an excuse to miss their targets.

With that said, Rivian’s financials are not great.

-193% gross margin is eye opening, in a bad way, but still somehow better than Lucid (-200% gross margin in Q2). Rivian clearly has a lot of overhead within COGS, but the standard overhead buckets (D&A and SBC) account for just $140mm of COGS. Even if you excluded those items, gross margin would still be -155%.

It’s also alarming that Rivian is spending $1B in operating expenses per quarter. Rivian’s expenses are very bloated, both in COGS and opex, partly because they’re launching 4 vehicles simultaneously. This is unprecedented for any EV OEM and partly due to the company’s agreement to produce commercial vehicles for Amazon.

I won’t go into more detail here since I’m already working on an analysis comparing Rivian and Lucid. This will be posted for free in about a month, so stay tuned.

EV Tax Credit passes the Senate and House of Representatives

News: On August 7 and 12, the Senate and House of Representatives approved the Inflation Reduction Act, respectively. The final step is getting President Biden’s signature, which should come shortly. There are no substantial changes to the EV tax credit relative to the prior version, which I summarized here.

My thoughts: The bill is fine but not necessary given the level at which demand exceeds supply. Mandating tax credits for 10 years, lifting the per-manufacturer limit, and qualifying trivial 7 kWh battery packs should ultimately cost the U.S. a lot of money.

However, strict supply chain requirements could disqualify many EVs. The bill states that at least 50% of minerals must be extracted or processed in the U.S. or a free-trade agreement nation by 2024, which rises to 80% by 2027. Additionally, 60% of battery components must be made or assembled in North America by 2024, which rises to 100% by 2029. Several automakers have voiced significant concerns that this will disqualify most cars. It’s still unclear which OEMs will meet the requirements, but it’s clear that companies need to focus on localizing supply chains ASAP.

The primary beneficiaries of this bill are the large domestic OEMs, who all have a strong manufacturing presence in North America. Tesla and GM stand to benefit specifically as the only two OEMs without access to the $7.5k credit today, so the new bill will even the playing field for these two automakers.

Conversely, the bill’s requirements put some OEMs at a disadvantage. Chinese automakers, such as Nio (NYSE:NIO), Xpeng (NYSE:XPEV), and BYD (SEHK:1211), will struggle to meet the supply chain requirements given their heavy manufacturing and supply chain presence in non-qualifying countries. Lucid (NASDAQ:LCID) and Rivian are also disadvantaged because their products exceed the $80k SUV and $55k sedan retail price thresholds. Of course, both companies plan to introduce more affordable cars over time, but that will take years. Both Rivian and Lucid benefit from the $7.5k credit today, and have found a loophole to qualify orders before year-end, but will now be at a disadvantage for new orders beginning in 2023.

Supply chain updates from CATL and Tesla

News: On August 12, CATL (SZSE:300750) announced that it would be investing €7.3B to build a 100 GWh battery plant in Hungary. This plant would be CATL’s second European battery plant and the largest European plant altogether. Mercedes-Benz said it would be the first partner to receive battery cells from CATL’s Hungary plant.

Separately, on August 8, a senior Indonesian cabinet member says the country signed contracts with Tesla to supply $5B worth of Nickel over 5 years. This is the largest nickel contract agreement that’s been publicly disclosed by any company.

My thoughts: This is important because the supply chain is critical to ramping production. CATL’s plans to build the largest European battery plant is a big development for local OEMs like Daimler/Mercedes (XTRA:MBG), Volkswagen (XTRA:VOW3), and BMW (XTRA:BMW). With the first and largest purchase order from this new plant, Mercedes specifically stands to benefit the most.

Tesla’s Nickel deal is also significant. $5B is enough to purchase ~250k metric tons of Nickel, or enough to produce ~5mm EVs. Tesla has signed other large Nickel agreements this year, including with Vale (BOVESPA:VALE3) in Brazil, announced in March, and Talon Metals (TSX:TLO) in Minnesota, announced in January.

Baidu receives approval for driverless taxi rides

News: On August 7, Baidu (NASDAQ:BIDU) received approval from two Chinese cities, Wuhan and Chongqing, to charge passengers for driverless taxi services. Baidu is the first company to receive this approval in China.

My thoughts: This is an interesting development that didn’t get enough coverage in my opinion. China is the world’s largest auto market, most populous country, and home to some of the most advanced automotive technology. Chinese companies are ramping production of some of the most compelling EVs globally, well ahead of legacy automakers in the U.S. and Europe, and have also demonstrated strong driverless technology. This approval has less restrictions than what Cruise was recently approved for in San Francisco, as Cruise can only operate between 10pm-6am while Baidu has approval for peak daytime hours.

With that said, there is some nuance that makes this less impressive than it seems. While drivers don’t need to be present in the vehicle, there must be a remote driver that can take over, if needed. It’s unclear how much of an impact these remote drivers have and how often they’re intervening so we’ll need to see more data before we can call these vehicles fully autonomous. Waymo and Cruise also use remote drivers that act as supervisors, but are not relied upon to operate the vehicle.

The competitive landscape for autonomous vehicles is much different in China than in the U.S. Neither Waymo or Cruise have significant operations in China, while Tesla’s full-self driving (FSD) software is also much less developed in the region. On Tesla’s Q4’20 earnings call, Elon Musk said that just 1-2% of Chinese buyers include FSD with their vehicle purchase, which is a fraction of the take rate in the U.S.

EV market share rises rapidly in California

News: On August 9, California released Q2 registration data showing that EVs are rapidly gaining share in the the nation’s largest auto market (~12% of U.S. drivers). In H1’22, fully electric vehicles accounted for 15.1% of new car sales in California compared to 5.4% for the entire U.S.

My thoughts: It’s no surprise that California has the highest share of EV sales in the country given the state’s high gas prices, tech-centered culture, and more eco-friendly demographic. What’s notable is that excluding California, YTD share of pure EVs is just 4.0% in the U.S. For context, pure EVs made up 13% of new car sales in Europe and 20% in China YTD. This shows how early the U.S. is in the EV adoption curve.

Another notable data point is Tesla’s Model Y and Model 3 were the top 2 selling cars in the state in H1’22.

While there are no other EVs in the top 10, this is important because it shows that fully electric vehicles can be the top-selling models, even in an ICE-dominated environment. This is impressive for a few reasons:

Since pure EVs had only 15.1% share of new car sales during this period, most buyers are still not even considering an EV today. Tesla is also one of only two OEMs without access to the U.S. EV tax credit, GM being the other.

Teslas are more expensive than other models listed. Both the Model Y (starting at $66k) and Model 3 (starting at $47k) are roughly double the price of the RAV4, Corolla, Accord, and Civic and are also more expensive than most of the pickup trucks listed. Tesla is also the only brand listed that doesn’t advertise.

Tesla’s market share in California is limited because its Fremont factory serves the entire U.S. today. Tesla’s local market share is set to increase with the introduction of their newest factory in Austin, which will allow Fremont to further prioritize West Coast deliveries once ramped.

Tesla’s individual model sales figures do benefit from the fact that Tesla only offers two affordable models compared to several models for other brands. The Toyota brand still maintains the strongest overall market share in California (17.9%), but Tesla is quickly catching up and already in second place (10.7%). It will be interesting to see how these trends extrapolate to other states as EV adoption rises.

If you’ve made it this far, please consider subscribing or sharing! Thanks for reading

For a very long time, California has been the birthplace of technological trends that eventually spread to the entire US. I think this is no different. My guess is by 2025, CA will approach 40-50% EV market share and US will be 20-25%

Very insightful analysis. I think the tax credit will help accelerate EV adoption, but the main issue is the lead times to deliver these vehicles.